Introduction

This article focuses on effective supplier management. The article is orientated towards indirect spend, however many of the principles apply to all spend categories.

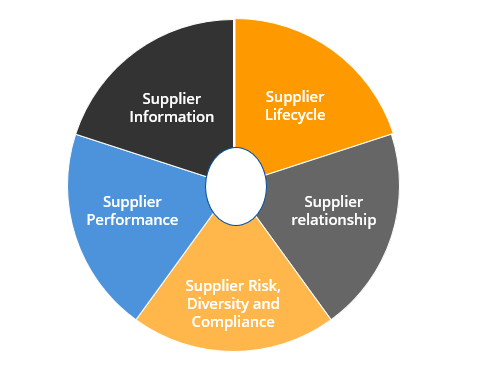

The five pillars of effective supplier management covered in this article are:

1. Supplier Information Management

As you might expect, with any supply network, there is a need to be a database of information related to each supplier.

The first thing to address, with relation to our supplier information, is how this data is to be classified and approached. A schema needs to be developed that will apply to all suppliers.

Plus, the metadata providing information about aspects of the data, needs to be developed. This is usually provided through tools and configuration on spend management platforms, simplifying this process for the administrator.

Permissions and integrations

Next, we need to think about permissions relating to supplier data. Who has access to this information and what fields are accessible to them, to see or change?

Then consider the Integration necessary with each supplier. Is there a need to link into their systems relating to inventory/Warehousing or catalogues, for example? This links into consideration of what content should be external or held internally.

We need then to consider the level of self-service we want to provide to our suppliers. What analytics should they have access to and when can they change specific information (e.g. when and how can they submit quotations)?

Rules and tolerances

Lastly, and perhaps most importantly, we need to set up some rules and tolerances for both our supplier and our users. For example:

- should a supplier be available to all users or restricted by location?

- How much can a user spend in a single month with a supplier?

- Should a supplier be visible before they become a preferred supplier?

- What tolerance is allowed, relating to a specification, for goods to be accepted?

Typically, on Indirect Spend, suppliers can be engaged by users; how should these suppliers be viewed and handled by Procurement and other users? Other rules may relate to tax or export restrictions.

2. Supplier Lifecycle Management

Supplier Lifecycle Management relates to the Orange part of our supplier cube graphic. Moving suppliers through and managing suppliers in context of their status.

In the case of Indirect spend, suppliers ultimately will fall into the status of Approved, Preferred or Contracted, typically governed by the business values associated with the Supplier, though other factors can govern the supplier status.

No Relationship

No relationship means just that. There is no current relationship with the supplier. This could mean that the supplier has been identified by a user and added to the system in anticipation of making a purchase or it could be that the Procurement team has added a supplier target to the list of suppliers.

Under Review

This status relates to the Procurement team reviewing a supplier that has been added to the system. This may gate any purchase or it may be a parallel process to a purchasing activity. Under Review includes appraisals of various aspects of the supplier’s capacity such as financials, quality assurance, organisational structure and processes and performance as well as adherence to supplier policies and terms of the procuring organization. In addition, pricing and guaranteed quality of service levels would of course be factors of review. The depth and level of review, relating to Indirect Spend, will depend on the nature of the supply. For example is it a one off purchase? Is it for items of very low value or is it an ongoing catalog item? However, whatever the nature of supply, there are Conformance and Social Responsibility aspects that must be covered, for example the impact of using a supplier who is using slave labour would have significant financial and image consequences for any organisation.

Evaluation

This status is where a supplier is engaged and test purchases are being made. This activity could be restricted to certain users or locations for this evaluation period. The period over which a supplier would be evaluated would depend on the organisation and the nature of the purchased goods or services.

Evaluation factors would include product and delivery assessment and compliance to specifications, quality level and returns, on-time delivery, willingness to change product/services and to meet changing needs and how well the Supplier communicates and engages.

Evaluation could include a questionnaire, an interview or site visit. A supplier could be returned to this status from a higher level status if there are concerns over the use of the supplier.

Approved

This status is perhaps self-explanatory. It means that checks have been made associated with the supplier and that the evaluation period has passed successfully. Typically, based on the information obtained, via the evaluation, a supplier is scored and either approved or not approved. Of course, to reach this point it is essential that there has been some competitive process whether internal or external, and in some cases both.

The competitive process typically includes evaluation against a group of relevant criteria. Most organisations have an approved suppliers list with a policy that a supplier must be on this list for an employee to make a purchase. If the supplier is not on this list and a user is making a purchase then there is usually a process of referral to procurement for approval. This process needs to be automated, in the case of Indirect Spend, and not throw up any significant barriers to purchase for the user.

Preferred

Again, this Preferred status is very organisation specific. Typically, this is associated with Procurement objectives that have been set up around specific suppliers. It might be that this is associated with Local suppliers being preferred or trying to promote diversity of supply, however the most likely reason is that there are some financial advantages in volumes through a particular supplier or a supplier has become valued over a period of time on delivery and quality characteristics.

Setting a status of Preferred is obviously intended to promote a particular group of suppliers over other suppliers, that are only classified as ‘Approved’. However, such a list of suppliers must be in constant review based upon performance of the suppliers. In the case of Indirect Spend this means an automation of the monitoring so that alerts can be used in preference to any manual reporting and review of data per supplier.

Contracted

The next status is Contracted. Contracting a supplier is usually a financial-based decision in the Indirect Category case however more generally this could be for reasons of securing certainty in the supply chain.

Contracts are put in place for many reasons and they would usually cover specifics that are not covered in standard terms and conditions of supply (either the suppliers or the buying organisations terms.) This could be volume discount terms or inventory terms for example.

These contracts can also be Framework based contracts that cover the broad commercial terms for supply. Framework contracts typically require a contract under the framework to be agreed before a purchase can occur: this may just simply use the Framework Terms or there may be some specific terms to be added. Quotations can be used as a means of indicating conformance to additional commercial terms outside of a framework agreement.

3. Supplier Performance Management

Supplier performance management is a critical aspect of supplier management. The status of a supplier is governed in the most part based on their performance.

To reduce overhead, it is important that the automated process itself captures the detailed raw data to be able to monitor performance.

Appropriate KPIs need to be set for suppliers and product supply areas and appropriate weightings set, associated with these KPIs.

Supplier scorecards can be used or simple dashboards showing supplier performance over time.

It should be possible to make supplier comparisons and provide feedback loops to suppliers on their relative performance: ranking of suppliers for internal use and indicating to suppliers where they sit in rankings and possible remedial actions that may be necessary in terms of performance gaps and agreement of actions to achieve desired performance levels.

Indirect Spend

For Indirect Spend the management of actual performance needs to be on a near real time basis, as Indirect Spend categories are typically Real Time events.

Given the Real Time nature of Indirect Spend, the use of Dashboards and threshold alerts is important for supplier management: if information is not available at the time an issue has occurred it may be that an opportunity is missed to effectively address this issue.

Performance management can cover many aspects, including Product quality, delivery, behaviour, SLA and Contract (specific terms of contract not being met). Exclusions of course need to be made associated with issues outside of a suppliers control.

Also, recording improvements made, for example to supplier performance or product quality, allows the tracking of how a supplier has continually improved over time.

4. Supplier Risk, Diversity and Compliance Management

These areas are linked but perhaps not directly related to each other. It may be that they should be broken out but, in the interests of staying with 5 pillars, they are combined for this article.

Supplier Risk

Supplier risk can be associated with use of single-sourced supply or it can be associated with a behaviour of the supplier. In the case of indirect spend the risk to the business may be less than that of direct spend, however, whatever the spend, domain risk must be assessed.

Mitigating risk of supply from a single source can be addressed in part either by seeking an additional supply source (if this is possible for the product or service being purchased) or by contracting with the single source supplier in a way that minimises the potential risks of loss of supply.

Perhaps a more significant and overlooked aspect of risk is associated with the supplier behaviour. This could for example be associated with fraudulent activity, labour practices, unrealistic commitments or discriminatory behaviour. Any of which could impact on your organization both in terms of supply, but perhaps more importantly in terms of reputation.

How do you mitigate risk in this case?

Leveraging business intelligence mitigates supply risks to some extent. Supply chain intelligence will leverage multiple sources of disparate data and information. It will examine historic and current information from countries, regions, and markets that are prone to particular supply risks, like major weather events, modern slavery and acts of terrorism as well as categories and suppliers that are historically at higher risk for these and other supply-related issues.

It will present decision makers and business users with country-risk indices, supplier-risk scores, and predictive indicators that a particular supplier, country, or category poses a risk.

Broad initial risk categorisation associated with indirect spend is a good way of reducing the potential risk, allowing for exclusion of suppliers and for alerts associated with sourcing from areas where risk is perceived as high.

Diversity

Diversity does link to risk in many respects. Diversity is, in part, about reducing risk by adding options for supply into the pool of suppliers available to an organisation. However, it can also increase some risks. See our article on supply diversity for more information on this link to risk.

Diversity is an important aspect of supplier management with an increasing obligation for organisations to respond on diversity. Using diverse suppliers in the indirect supply chain is an area of focus as this minimises risks to the core business associated with changes of suppliers.

Focusing on automation of the 5 Pillars discussed in this document will minimise risk of adopting a diverse supply chain and help with the onboarding process for these suppliers and the monitoring of their performance over time.

Compliance

We are going to talk of compliance here in terms of two aspects:

- Compliance with the external rules that are imposed upon the Supplier – governing law

- Compliance to any country specific laws or terms of conditions of supply to an organisation

These two areas of compliance may totally align, if both the supplier and the organisation are in the same country.

Compliance to governing laws that the supplier will adhere to will depend on where the supplier is based. It is therefore important that there is clarity not only on which country laws apply but also on what these laws expect from the supplier.

For example, applying specific laws associated with your organisation’s country laws, seems obvious. However the compliance aspect is of greater concern: how do you know a supplier is complying with these laws and what risks are you running using a specific supplier? Are they complying with their local laws but breaking the laws applicable to your organisation and by association placing your organisation in breach of these laws?

Compliance to Terms and Conditions

The second point also covers compliance to terms and conditions of supply. This aspect covers the use of Spend Management systems and the links between these systems and the purchasing process overall. Essentially monitoring compliance to the rules associated with the procurement process and the terms and conditions of being a supplier to the organisation.

Note: compliance can also be used in context of compliance to specifications. However, here we are covering this aspect in the Supplier Lifecycle section.

5. Supplier relationship and engagement Management

Wikipedia defines this as “the systematic, enterprise-wide assessment of suppliers’ assets and capabilities with respect to overall business strategy, determination of what activities to engage in with different suppliers and planning and execution of all interactions with suppliers in a coordinated fashion across the relationship life cycle to maximize the value realized through those interactions.”

An excellent definition for strategic purchases, however for Indirect Spend perhaps we need to reword slightly as follows:

“the automated systematic assessment of suppliers’ capabilities with respect to overall business objectives, determination of what activities to engage in with different suppliers, and planning and automating execution of all interactions with these suppliers in a coordinated fashion across the relationship life cycle to maximize the value realized through online interactions.”

We have changed the emphasis towards a more automated interaction and engagement for Indirect suppliers as, for many of these suppliers, an online interaction may be the only interaction and interface towards the purchasing organization.

Plus, where there is more engagement outside of these automated processes, this will more likely be sporadic and usually triggered by purchasing events. These interactions, whether single purchases or for call-off supply, needing to be captured within the automated process to ensure ongoing spend visibility and control for Indirect Spend.

Not all suppliers are created equal

Of course, not all suppliers are created equal. There is a need to recognise that not all suppliers are the same and therefore not all customer-supplier relationships should be dealt with through a single approach. This is definitely the case for Indirect Spend Categories, where the range and variety of purchasing decisions being made is significant and single process interaction tools are totally inadequate to manage this spend.

Opportunities to engage with suppliers can occur at many stages, including initial evaluations, Customised RFx processes, Specification questionnaires and Invitations to bid. Any interaction should be seen as an opportunity to engage the suppliers. Whether this is totally automated or involves personal contact the process should support a positive experience for both parties involved.

In the case of Indirect Spend, Supplier Relationship Management should be regarded as the automation of a company-wide philosophy aimed at securing greater competitive advantage from the supply base.

To unlock value; drive performance and supply side improvements; increase effectiveness of interactions with suppliers; reduce, eliminate or manage supply side risk; and identify supply side innovation.

6. Summary

The five pillars of effective supplier management covered in this article were: Supplier Information Management, Supplier Lifecycle Management, Supplier Performance Management, Supplier Risk, Diversity and Compliance Management and Supplier Relationship Management.

This article focused on some of the issues and specifics associated with supplier management in context of indirect spend where the level of touch is significantly less than that for direct supply categories and the real time nature of information is more important to be able to manage Indirect Spend.

The article also highlighted the need for process automation and the need to capture data as part of the procurement process to effectively manage suppliers in the indirect spend category.

If you would like to learn more then please visit our articles section and sign up to receive more articles.